Time Deposit Interest Rate

Do you know that one of the easier ways of making your money work for you is by investing in a time deposit account? A time deposit account is an investment account and a type of savings account in which money is deposited for a stated period of time and a fixed interest rate is paid at the end of that period.

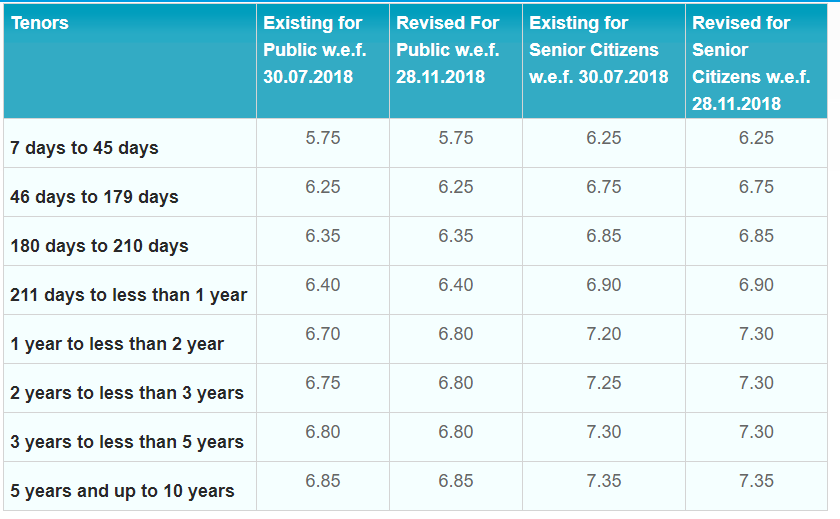

To calculate your expected interest return, simply enter your deposit amount, number of days and the annual interest rate. Time deposits, also known as certificates of deposit, pay a much higher interest rate but require a minimum deposit and tie your money up for a set period of time, which can range. A specific amount of funds in peso which earns interest at a pre-determined competitive rate for a fixed period of time/term with a “Certificate of Time Deposit” (CTD) as proof of deposit. This is offered to individuals and institutions with peso denominated funds which may be locked-in with the bank for at least thirty (30) days. Foreign Currency Time Deposit (Terms: 30, 60, 90, 180 days) US Dollar Time Deposit. USD 1,000: N/A: N/A: See below for table of interest rates: Renminbi Time Deposit: CNY 5,000: Euro Time Deposit. EUR 500: Japanese Yen Time Deposit. JPY 50,000: Singapore Dollar Time Deposit. SGD 1,000: Australian Dollar Time Deposit. AUD 1,000.

It is a safer investment option when compared to other investment types. Opening a time deposit account is both quick and easy and all you have to do is to deposit money into the account for a given period of time, for it to earn interest for you.

Below are reasons why you should open a fixed deposit account today:

1. It encourages a savings habit as the money you deposit needs to be in the account for a period of time without you making any withdrawal.

2. Investing in a time deposit account earns you a higher interest rate than depositing your money in a savings account.

3. You are assured of returns for your investment

Bpi Time Deposit Interest Rate

Time Deposit Interest Rate Metrobank

4. The account helps to act as a fall back for your business in the event of a cash flow squeeze or can be used to meet your future cash requirements.

5. Interest is payable at maturity; annually or monthly depending on the term you chose or you could use the money to buy assets if you want.

6. You get to choose how long you want to invest your money in a fixed deposit account ranging from 30 days to three.

7. You can choose to have more than one time deposit account if you want to save for different goals.

eCompareMo partners with the leading banks to provide you with impartial and up-to-date information on all financial products in the country. With our state-of-the-art time deposit calculator, you can compare and contrast all time deposit interest rates in the Philippines to find the best one that can give your investment a head start.

What is a time deposit?

A time deposit, or a certificate of time deposit, is an interest-bearing bank deposit that has a specified date of maturity. It is a bank account type option for customers who would like to deposit available excess funds in a high-interest account type. This is issued for a specified term, such as 30 days (minimum) up to five years. Funds can be withdrawn without prior notice, or before the maturity date, though there are penalties for early withdrawal.

Forms of deposit can be through cash, check (personal or managers check) and fund transfer from an existing account maintained at the same bank where the time deposit will be placed.

Why do I need to open a time deposit account?

The more money you invest in a time deposit, the more you'll earn. Also, with its better interest rates, one of the benefits of time deposit is it secures higher yields from your savings. Choose from any type of time deposits—traditional, mutual fund, fixed, term deposit with interim interest, flexible—and let your money grow.

How to open a time deposit account

Our advanced calculation engine allows users to make a fast and easy comparison of all time deposit interest rates offered by banks in the Philippines—guaranteed free. Applicants can get detailed information, such as minimum initial placement, placement term, withholding tax, rollover allowance, certificate of time deposit, and other requirements.

After doing a comparison using eCompareMo’s time deposit interest rate calculator, you can immediately invest for a time deposit online. By using our platform, you can save time and money in choosing the right time deposit account.

To open a time deposit account, all you need is a digitized ID, such as an SSS ID, Driver’s License, Voter’s ID, Company ID, and the like.

Receive top-notch support from our customer service agents

Our customer helpdesk is more than willing to answer your questions regarding the product/s of your choice. Our highly trained agents also provide you with financial advice and other information that will help you make an informed decision about time deposit.

Data security is our top priority

Your security is paramount to us, that’s why at eCompareMo, we use global standards in data privacy and security. With an encrypted data protection system, you can be sure that all your personal information is protected. We will never share any of your data with other parties without your consent.

Helping millions of Filipinos save time and money

eCompareMo helps Filipinos achieve financial freedom through financial products and services. By using our service, customers can simplify their process of searching for the best products that are tailored to their wants and needs.

Aside from financial comparison services, we also provide insightful, informative, and inspirational articles as well as social media campaigns that aim to reach out to people looking for financial freedom in their lives.

With eCompareMo, opening a time deposit account in the Philippines has never been easier.