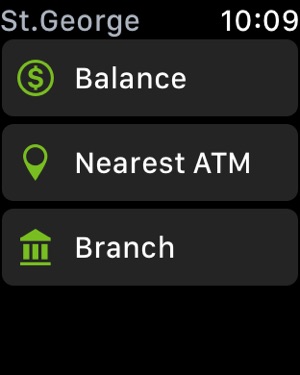

St George Bank Term Deposit Rates

.jpg)

- Gateway's deposits are guaranteed under the Government's Financial Claims Scheme. Standard term deposits. The following interest rates apply to standard term deposits where interest is paid at maturity or periodically to a savings account. For compounding term deposit interest rates, please see our Interest Rate Schedule. Term Deposit Rates.

- The St.George Bank Incentive Saver rewards you with bonus interest when you make regular deposits. To earn the maximum variable rate of 0.45% p.a. Customers aged 21 and over need to grow their.

- And you’ll be able to have all that interest paid into your St.George bank account or an account at another bank if you want, either as direct credit or cheque. The minimum amount of money you’ll need to open a St.George Term Deposit is $1,000, and the maximum amount is $2,000,000.

St George Internet Banking Term Deposit Rates

Melanie Evans

Chief Executive Officer (CEO)

Melanie joined ING in 2017 to lead the Retail Bank for ING Australia. She was appointed country CEO in November 2020.

Melanie has spent her career in financial services. Starting out with a St.George Bank cadetship in 1995, she later joined Westpac’s equities business in 2000. After a move to BT Financial Group in 2003, she spent a decade in product, brand, marketing, superannuation, platforms and investments leadership roles.

Returning to banking within the Westpac Group as a Chief of Staff, she then went on to lead business units across mortgages, transformation and business banking. In 2017 she moved to ING, leading ING's retail growth and diversification agenda.

Melanie volunteers her time as an independent director on the Board of Surf Life Saving Australia (SLSA) and is Chair of the SLSA Finance, Audit and Compliance Committee. Melanie is also a Board Member of the European Australian Business Council.

Glenn Gibson

Interim Head of Retail Banking

Glenn Gibson is the Interim Head of Retail Bank and member of ING Australia’s Executive Committee.

He joined ING in 2018 as the Head of Third Party Distribution and Direct Mortgages before adding Customer Service and Experience to his remit in 2019. In November 2020 he took on the role of Interim Head of Retail Bank.

Glenn’s career in financial services has spanned 35 years. During this time he has held senior leadership roles in distribution, marketing, credit and operations with a focus on best practice customer experience.

Prior to working at ING, Glenn was responsible for all mortgage and third party deposit distribution for AMP Bank, where he guided its broker, direct and retention channels to deliver significant year-on-year growth and market share.

Glenn has been involved in the third party introducer market for over 25 years and is an active participant in numerous industry consultative bodies including: the Combined Industry Forum and Mortgage & Finance Association of Australia (National Lenders Committee).

Charles Ho

Head of Wholesale Banking

Charles is responsible for ING’s Wholesale Banking activities in Australia. Charles joined ING in 2008 in Singapore as part of its regional Utilities & Infrastructure team where he was involved in a wide range of structured finance and debt advisory deals across the Asia Pacific region. In 2013, Charles moved to Sydney to establish the Utilities & Infrastructure team in Australia.

Prior to ING, Charles worked with DBS and Citibank in industry coverage and lending roles where he built up key experience in lending, capital markets, and financial markets. Charles has more than 17 years of experience in the financial services sector with Citibank, DBS, UOB, Ernst & Young and ING covering project finance lending, debt advisory, client coverage and client advisory roles.

Charles holds a Bachelor of Engineering in Mechanical Engineering, from Imperial College and is a FCA with the ICAEW.

Alan Lee

Chief Financial Officer

Alan is an experienced banking executive having worked for over 20 years across retail, wholesale and investment banking organisations in Australia, Asia and Europe.

In his current role as Chief Financial Officer Alan is responsible for ING in Australia’s strategy, planning and ensuring the bank achieves sustainable financial performance. He remains accountable for the management and financial accounting functions, procurement and taxation.

Alan has more than 18 years’ experience at ING working across finance, risk management, operations and internal audit.

In 2011 Alan spent 12 months working in the ING Head Office based in Amsterdam before relocating to Singapore. In 2014 Alan was appointed the Asian Regional Chief Financial Officer of ING Wholesale Banking where he was responsible for finance activities across 13 markets in Asia. In January 2016, Alan returned home and commenced his role as Chief Financial Officer at ING in Australia.

Alan started his career with PWC and holds a Bachelor of Commerce degree from the University of Queensland. He is a member of the Institute of Chartered Accountants in Australia and NZ and is also a certified Internal Auditor.

Linda Da Silva

Chief Information Officer

Linda Da Silva joined ING Australia as Chief Information Officer in December 2019. In this role she leads the Technology and Data teams to deliver the digital agenda for ING.

Prior to joining ING, Linda held a number of senior leadership roles at Westpac Banking Corporation managing large complex areas spanning Consumer Bank, Group Operations and Enterprise Services. Her last role at Westpac Group was CIO BT Financial Group.

Linda joined the Westpac Group in 2008 following a 15-year career in IT consulting and leadership roles in Australia, Asia, Middle East and the UK. As a consultant Linda worked across many industries to deliver large-scale transformation programs.

Linda holds a Bachelor of Economics degree, is a CPA and a member of Australian Computer Society. She is also a member of UNSW Student Industry Advisory Group providing leadership for post graduate students and independent advice for the UNSW 2025 strategy. Linda is also a board member of the NPP (New Payments Platform) Australia Limited.

Patrick Roesink

Chief Risk Officer

Patrick Roesink is Chief Risk Officer at ING in Australia, appointed July 2020.

Patrick is an experienced risk manager and banking professional. He has more than 25 years' senior management and risk experience within ING across Europe and Asia. His previous role was Chief Risk Officer at ING in Poland.

Patrick is passionate about innovation, new technologies, transformation and self-improvement.

Patrick has a deep knowledge of credit risk management both corporate and retail, structuring corporate lending transactions and derivatives and a firm background in market risk management and operational risk management.

Patrick finished his Masters in Business of the Financial Sector at the Vrije Universiteit in Amsterdam. He holds certificates from the Saïd Business School, University of Oxford in the areas of Fintech and Blockchain.

Michael Witts

Treasurer

Michael joined ING Bank in 2009 as Treasurer, responsible for the funding and liquidity management for the Bank.

Prior to joining ING Bank, Michael held various roles in treasury, derivatives and liquidity risk management, at domestic and international banks including Macquarie Bank, Deutsche Bank and the Commonwealth Bank.

In addition, to his extensive experience in Australian financial markets, Michael has worked in both Tokyo and Frankfurt, managing the pricing and risk management of derivative and funding transactions, and overseeing staff in dealing, marketing and middle/back office functions.

Michael holds a Bachelor and Master of Commerce degrees in Economics/Finance from the University of New South Wales. He is a Senior Associate of the Financial Services Institute of Australasia (FINSIA); a Certified Finance and Treasury Professional (Senior) of the Finance and Treasury Association (FTA); and is a Graduate of the Australian Institute of Company Directors.

Adriana Sheedy

Executive Director, Operations

Adriana Sheedy is the Executive Director, Operations at ING where she has been a member of the team since 2000.

Adriana has held various roles throughout her career including Head of Operational Risk and Anti-Money Laundering Program Manager.

In her current role, Adriana is responsible for transforming the bank’s processes to drive industry leading customer satisfaction, scalability and reliability for the retail and wholesale banking business lines. She leads a broad range of functions covering Transformation, Payments, Credit Operations, Collections, Facilities and First Line Risk Management.

Adriana is passionate about leading people and fostering an engaged team. She is motivated by both transformational and continuous improvement for herself, her people and the customers she serves.

Tim Newman

Head of KYC

Tim Newman is the Head of KYC at ING Australia. In this role Tim is responsible for execution of ING Australia's anti-money laundering (AML) program.

Tim brings a wealth of experience from ING in Australia where he's held a number of senior roles including Interim Executive Director of Operations and Head of Customer Experience & Service. Tim has also been responsible for leading strategy and planning, everyday banking and mortgage products, as well as various roles within mortgage distribution.

Prior to joining ING Tim worked in a number of analyst roles at Mortgage Choice. He holds a Bachelor of Business Studies, Management.

Fiona Monfrooy

Executive Director, Human Resources

Fiona is an accomplished, commercially focused HR leader and seasoned Executive Team Member with experience in organisational development, leadership development, talent strategy, employee engagement, internal branding, M&A, culture change, and organisational transformations in growth and cost challenged environments.

In her role as Executive Director, Human Resources, Fiona reports to the CEO and is a key member of the ING Executive team. She is responsible for overseeing all Human Resources and organisational development within the business.

Prior to joining ING, Fiona held positions with Yahoo7, Volante/Commander, Ticketek, Vodafone, and SBS Television.

Fiona is a member of the Australian Institute of Company Directors and Australian Human Resources Institute, holds a Masters of Management (Distinction) with the University of Technology, Sydney, and holds a Professional Diploma in Human Resource Management from Deakin University.

St George Bank Term Deposit Rates Chase Bank

Fixed rates start from 0.05% p.a. For one month and go up to 0.35% p.a. For one to five years. With the St.George Term Deposit, you’re able to automatically rollover into a new term once the agreed period is over, or you can close the account at the end of the term.