Canara Bank Fixed Deposit

- Latest Updated Deposit rates News: Bank Offers 5.40% p.a. For Canara Tax Saver Deposit scheme (General Public). Maximum deposit acceptable is Rs 1.50 Lakh. You Can Invest As low as Rs.1000/- Per Month Minimum 15 days (7-14 days – Only for single deposit of Rs.5 lakh and above), Maximum 120 months.

- Canara Bank provides a wide variety of deposits than the regular fixed deposit. The Ashraya deposit scheme for senior citizens who are aged above 60 years can be opened either singly or jointly. In the case of a joint deposit, the other depositor can be below 60 years of age, however, the senior citizen is the prime depositor.

- See Full List On Canarabank.com

- Canara Bank Fixed Deposit Rates 2019

- See Full List On Etmoney.com

- Canara Bank Fixed Deposit Schemes

Table of Contents

Canara Bank offers different kinds of fixed deposits or term deposits option to domestic as well as NRI customers. The Canara Bank FD interest rates on these deposits are decent and provide guaranteed returns to its investors. Canara Bank offers higher fixed deposits interest rates to senior citizens.

- 2 Canara Bank Fixed Deposit in New Delhi at a glance

- 2.3 Address of Canara Bank Branches in New Delhi

About Canara Bank Fixed Deposit in New Delhi

Fixed deposit is one of the safest and risk-free modes of investment. In the city of New Delhi, where a number of people working are more the need of money is also more. For them, the secure way to tackle the needs and requirement is to place the money in the most convenient and safe place. The fixed deposit is the product offered by the financial institution where a certain amount 0f money is fixed for a brief period of time and the banks endow interest rate on it. so that the depositor gets the interest amount along with the deposited principal amount. Thus, one must avail it to extract maximum benefits from it.

Canara Bank Fixed Deposit in New Delhi at a glance

See Full List On Canarabank.com

| Particulars | Details |

|---|---|

| Interest Rate | 3.00% - 5.85% |

| Minimum Investment amount | ₹ 1000 |

| Tenure | 7 Days TO 10 Years |

Eligibility Criteria

Below mentioned individual or group are eligible for a fixed deposit

- The applicant should be the Resident of India.

- Individual

- Joint (max. 4 people)

- Hindu undivided family (HUF)

- A guardian on behalf of a minor

- Sole proprietorship firms

- Partnership firm

- Limited Companies

- Trust Accounts

Documents Required

Canara Bank Fixed Deposit Rates 2019

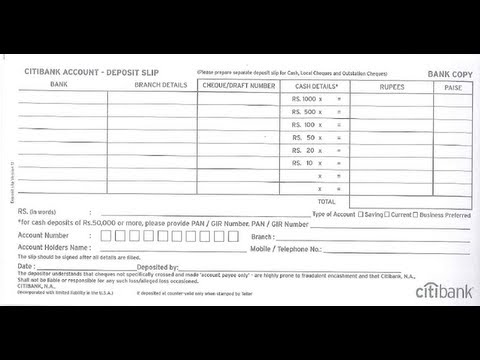

- Application form

- Copy of PAN Card / Form 60 or 61 (in case the customer does not have PAN Card)

- 2 Photographs of Depositor’s

- Identity Proof and Address Proof

- Any other related documents as applicable to proprietorship concern, Partnership Firm, Company, HUF etc.

To get more detailed information, visit Fixed Deposit New Delhi.

Address of Canara Bank Branches in New Delhi

See Full List On Etmoney.com

| Branch Name | Complete Address | IFSC | MICR | Customer Care |

|---|---|---|---|---|

| Delhi Connaught Circus F.19 | F 19, Connaught Circus, New Delhi - 110001 | CNRB0000143 | 110015004 | 011 - 23310856 |

| Kamlanagar, Delhi | 3/F, Kamala Nagar, Delhi 110007 | CNRB0000156 | 110015017 | 011- 2384 2498 |

| Delhi Diplomatic Enclave | Diplomatic Enclave, 5 Nyaya Marg, Youth Hostel Bld Chanakyapuri, New Delhi 110021 | CNRB0000157 | 110015007 | 011 - 26882267 |

| Delhi Deendayal Upadhyay Marg | Community Centre, 2 Mayapuri, Phase II, New Delhi. | CNRB0000158 | 110015005 | 011 - 23214531 |

| Foreign Department, Delhi | Sarojini House [AIWC], 6 Bhagwandas Road, New Delhi 110001 | CNRB0000179 | 110015008 | 011-23382400 |

| Delhi Fountain | 1487 - 1497, New Moti Cinema, Chandni Chowk Fountain, New Delhi 110006 | CNRB0000180 | 110015009 | 011 -22967223 |

| Delhi South Extension | G.25, South Extension Part I, New Delhi 110049 | CNRB0000267 | 110015031 | 011 - 2465 6169 |

| Delhi East Of Kailash | Suraj Prabhat Branch No.1 & 2, Comunity Centre, East Of Kailash, New Delhi 110065 | CNRB0000268 | 110015032 | 011 - 23363840 |

| Sadar Bazar, Delhi | Sadar Bazar, Narain Market, Delhi 110006 | CNRB0000271 | 110015029 | 011-2352 2568 |

| Quazi Hauz, Delhi | 5007, Jaisav Place, Bazar Sirkiwalan, Quazi Hauz, New Delhi 110006 | CNRB0000272 | 110015026 | 011 - 2321 5459 |

| Delhi Janpath | Post Box No.495, 74, Janpath, New Delhi 110001 | CNRB0000307 | 110015014 | 011 - 23323583 |

| Delhi Chandni Chowk | Post Bag No. 212, Kaisons House, Chandni Chowk , Fathehpuri, Delhi - 110069 | CNRB0000313 | 110015003 | 011 - 23935912 |

| Delhi Lajpath Nagar | A - 9 DDA Shopping Complex, Defence Colony, New Delhi 110024 | CNRB0000341 | 110015020 | 011 - 24647850 |

| Delhi S D Area | C - 16, Community Centre, Opp. Iii Main, S.D.Area, Delhi - 110016 | CNRB0000346 | 110015013 | 011 - 26960254 |

| Delhi R K Puram | Sector 12 R.K.Puram, Rao Tula Ram Marg, New Delhi 110022 | CNRB0000347 | 110015028 | 011 - 24122205 |

| Delhi Okhla Industrial Estate | 269&270, Fruit & Vegetable Mkt, Dda Okhla Indl.Estate, Delhi - 110020 | CNRB0000348 | 110015024 | 011 - 26842309 |

| Delhi Maharani Bagh | 4 Siddarth Enclave, Commercial, Complex, Maharanibagh, New Delhi 110014 | CNRB0000349 | 110015021 | 011 - 26912270 |

| Delhi Green Park Extension | No.9, Community Centre, Gulmohar Enclave, New Delhi 110016 | CNRB0000350 | 110015011 | 011 - 26965426 |

| Delhi Karol Bagh | P B No.2608, 10201, 202, Padam Singh Road, Karolbagh, New Delhi 110005 | CNRB0000367 | 110015018 | 011 - 225720487 |

| Delhi Wazirpur | 18, Community Centre, Central Market, Ashoka Vihar, Wazirpur, Delhi 110052 | CNRB0000387 | 110015035 | 011 - 27246318 |

| Daryaganj, Delhi | 34, Netaji Subhash Marg, Daryaganj, New Delhi 110002 | CNRB0000388 | 110015006 | 011-23273015 |

| Kashmere Gate Delhi | P B No 1689, Bhatnagar Bldg, I Floor 2772, Lothian Road, Kashmiri Gate, N Delhi 110006 | CNRB0000389 | 110015019 | 011-23920193 |

| Delhi Nehru Place | DDA Building, Nehru Place, New Delhi 110019 | CNRB0000390 | 110015016 | 011 - 26439215 |

| Tagore Garden, Delhi | Post Box No.6514, No.B - 7, 8, 9, Shopping Centre, Tagore Garden New Delhi 110027 | CNRB0000391 | 110015033 | 011-25433533 |

Canara Bank Fixed Deposit Schemes

ELIGIBILITY | Individual, Joint (not more than 4), a Guardian on behalf of a minor, HUF, Partnership, a Company, Association or any other Institution |

INVESTMENT | Minimum - Rs.1000 |

PERIOD OF DEPOSIT | Minimum 15 days (7-14 days – Only for single deposit of Rs.5 lakh and above) |

INTEREST RATE | Depending upon the period of the deposit as prevailing from time to time. |

PERIODICITY OF INTEREST PAYMENT | Monthly (at discounted rates), Quarterly, Half-yearly or Annual intervals as per depositor's choice |

SPECIAL RATE FOR SENIOR CITIZEN | Additional interest rate of 0.50% will be paid for domestic term deposits (including RD and except for NRO, NRE and Capital Gains Deposit scheme) of less than Rs. 2 Cr and with tenor of 180 Days and above, over and above the rate offered for General public. The system will automatically enable preferential ROI of 0.50% to all existing eligible Domestic Term Deposits and RD Deposits from the date of Customer attaining Senior Citizen status w.e.f. 24.07.2018 In case of death of the Senior Citizen before the date of maturity, the deposit may be continued with the contracted interest rate only if there is no change to the other contracted terms. |

TDS ON INTEREST | Applicable |

NOMINATION FACILITY | Available |

LOAN FACILITY | Available upto 90% of the deposit amount |

PENALTY FOR PREMATURE CLOSURE/ PART WITHDRAWAL / PREMATURE EXTENSION OF DEPOSIT: | A penalty of 1.00% shall be levied for premature closure/part withdrawal/premature extension of Domestic/NRO term deposits of less than Rs. 2 Crore that are accepted /renewed on or after 12.03.2019. For premature closure/part withdrawal/premature extension of Domestic/NRO term deposits, the Bank imposes a penalty of 1.00%. Such prematurely closed/part withdrawn/prematurely extended deposits will earn interest at 1.00% below the rate as applicable for the relevant amount slab as ruling on the date of deposit and as applicable for the period run OR 1.00% below the rate at which the deposit has been accepted, whichever is lower.” A penalty of 1.00% is waived in case of premature closure/part withdrawal/ premature extension of Domestic/NRO CALLABLE term deposit of Rs. 2 Crore & above that are accepted/renewed on or after 12.03.2019. However, a penalty of 1.00% shall be levied for premature closure/part withdrawal/premature extension of Domestic/NRO term deposits of Rs.1 Crore & above that are accepted /renewed from 04.02.2011 to 12.10.2012 Such prematurely closed/part withdrawn/prematurely extended deposits will earn interest at the rate as applicable for the amount slab of Rs.2 Crore & above as ruling on the date of deposit and as applicable for the period run OR the rate at which the deposit has been accepted, whichever is lower No interest will be payable on term deposits prematurely closed/prematurely extended before completion of 7th day. A penalty of 1.00% is applicable on Term Deposits under Capital Gains Account Scheme-1988, which are prematurely converted/withdrawn/closed, irrespective of the size of the deposit amount. |

EXTRA FACILITY | Facility of part withdrawal of deposits in units of Rs.1,000/- keeping the rest of the deposit to earn contracted rate of interest. |

AUTO RENEWAL OF DEPOSIT | Deposit shall be renewed automatically for a similar period on the date of maturity at the rate of interest applicable for the period as on the date of maturity, in the absence of any renewal instructions well in advance. Auto Renewal facility is not available for Canara Tax Saver Deposits, Capital Gains Accounts, Canara Samriddhi deposits(discontinued w.e.f. 01.10.2015), Canara Khazana and Shikhar Deposits (discontinued w.e.f. 26.03.2020) and Non-callable deposits. |

OVERDUE DEPOSITS | a) The deposit will be renewed automatically from the date of maturity for a similar period at the interest rate prevailing on the date of maturity for the period of deposit, if automatic renewal has been opted by the depositor at the time of opening of the deposit account (except deposits opened under Capital Gains Scheme, Canara Tax Saver Scheme & Non-callable term deposits). b) If automatic renewal of the deposit is not opted by the depositor and the deposit remains with the Bank after the date of maturity (even if the CBS system renews the deposit automatically), the same will be treated as an overdue term deposit from the date of maturity of the original deposit. The overdue term deposit will be paid interest at prevailing Savings Bank rate for the overdue period, i.e. from the date of maturity of the original deposit till the date of payment/ re-investment. |

APPLICATION & DOCUMENTS | Application in the Banks’ prescribed form. Copy of PAN Card / Form 60 or 61 (if customer does not have PAN Card). Photograph of Depositor/s (2 copies). Proof ofIdentity and address as per KYC Norms. Any other related documents as applicable to proprietor ship concern, Partnership Firm, Company, HUF etc. |